Posted in Legislative Research on Jan 23, 2020

This bill has been posted on the website of Pyidaungsu Hluttaw on 27th of December 2019.

Enacted laws

The Foreign Exchange Regulation Act, 1947

Foreign Exchange Management Law (2012)

Amendment to Foreign Exchange Management Law (2015)

Foreign Exchange Management Law (2012)

Foreign Exchange Management Rule - Notification No. 7/2014 - was issued by the Central Bank of Myanmar under the powers of the 2012 law, setting out rules for foreign exchange license holders in conducting their business.

Current situation

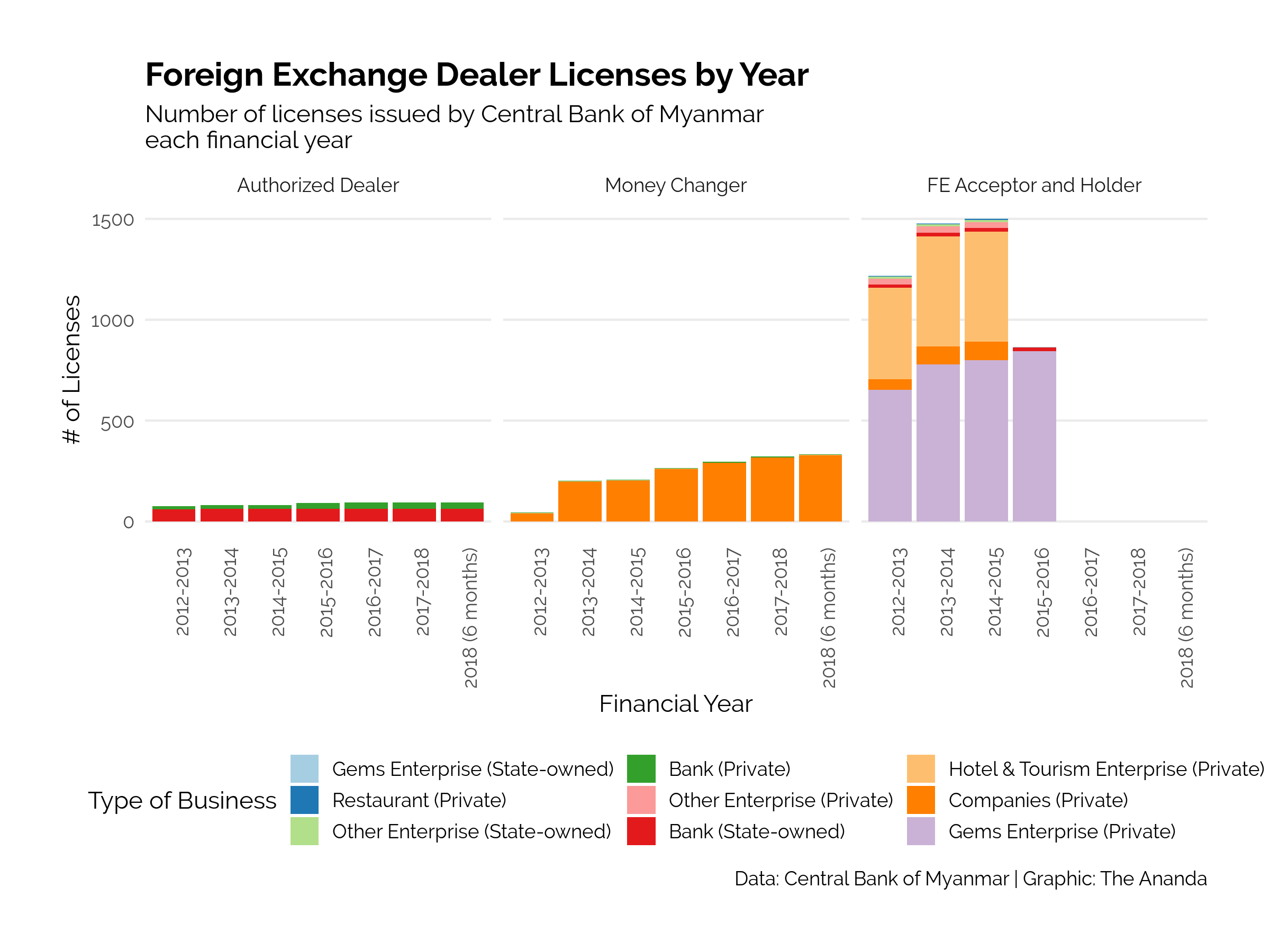

The Foreign Exchange Management Department issues three kinds of licenses to conduct business lawfully relating to foreign exchange:

- The Authorised Dealer License allows banks to conduct foreign exchange business. According to the statistics in the FY 2018 Transition Period Report, the license has been issued to 63 state-owned banks and 32 private banks.

- The Money Changer License permits license holders to sell, buy and exchange foreign money. Until 30th of September 2018, the license has been issued to 4 private banks, 1 under the category of hotel and tourism enterprise, and a total of 328 companies.

- The Foreign Exchange Acceptor & Holder License is issued to government departments, cooperatives and individuals to conduct foreign exchange, provided they are already have a business license. (Note that in addition to business registration through DICA, a range of other licenses are issued by different departments enabling companies to do business in different sectors.) 1501 licences were issued in 2014-2015, and 865 in 2015-2016. However, the license was revoked in the late months of 2015 with an announcement that paying for goods and services should only be with Myanmar currency (Kyat), and also aiming to reduce the use of cash.

Government policy

(1) Myanmar Economic Policy

The policy number 8 of Myanmar Economic Policy reads “Achieving financial stability through a finance system that can support the sustainable long-term development of households, farmers and businesses”.

(2) Myanmar Sustainable Development Plan (2018-2030)

The reference number 3.5.4 reads “Continue liberalization of the banking sector including through plans and regulations for the Financial Institutions Law (FIL) and Foreign Exchange Management Law (FEML)” and intends to get strategic outcomes “The legal and regulatory environment enables financial institutions to manage and price risk, secure creditor rights and claims, and inclusively finance sustainable growth”.

The Ānanda

The Ānanda